With the November 6 election date fast approaching, this year’s ballot will include an interesting question that would amend the Virginia Constitution:

“Should a county, city, or town be authorized to provide a partial tax exemption for real property that is subject to recurrent flooding, if flooding resiliency improvements have been made on the property?”

Virginia’s query is well-timed. Flood awareness in the Commonwealth is undoubtedly high after many Virginia communities, and much of the southeastern U.S., have endured several recent flood events. Virginia’s rainy spring and summer seasons gave way to an active Atlantic hurricane season that has seen two tropical systems impact most of the state within weeks of one another (remnants of Hurricanes Florence and Michael). As of this writing, the Richmond area alone has already received 125 to 150% of its average rainfall, year-to-date.

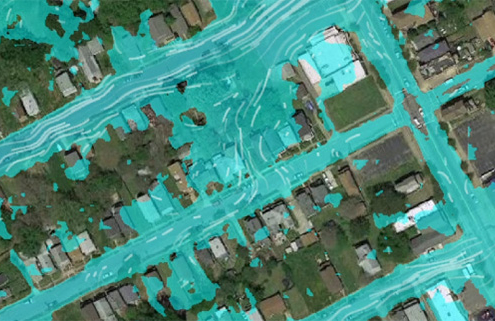

As Virginia experiences more frequent and severe rainfall events, along with increased tidal and coastal flooding, more properties face flood risks, causing significant, and often repetitive, damage. Flood damage will only increase as storm frequencies and severity increase. Coupled with anticipated sea level rise along Virginia’s tidal shores, the state has recognized the need to look for additional, long-term flood mitigation solutions. This ballot initiative seeks to incentivize private property investment in flood mitigation and resiliency measures by allowing Virginia localities to provide partial real estate tax exemptions for properties that do so.

As with many proposed solutions that sound straightforward on paper, the necessary details can often prove complex — and this initiative is no exception. Virginia’s constitution already enables a similar, real estate tax-based incentive program for “real estate whose improvements, by virtue of age and use, have undergone substantial renovation, rehabilitation, or replacement…” [Article X, Section 6 (h)]. This currently enabled real estate tax incentive for rehabilitation of existing properties assists community efforts to stabilize, and often increase, the local tax base. However, the dynamic nature of flooding and flood damage in Virginia, from both a geographic and hydrologic perspective, challenges the efficacy of a constitutional change that would require consistent statewide implementation. To that end, the actual text of the proposed constitutional amendment, below, does leave room for addressing these challenges. As currently drafted, it reads:

Article X, Section 6 “(k) The General Assembly may by general law authorize the governing body of any county, city, or town to provide for a partial exemption from local real property taxation, within such restrictions and upon such conditions as may be prescribed, of improved real estate subject to recurrent flooding upon which flooding abatement, mitigation, or resiliency efforts have been undertaken.” (Emphasis mine.)

As colleagues have recently reminded me, if the ballot measure passes, the Virginia General Assembly will need to introduce a bill (or bills) in the 2019 session to define the initiative, including the restrictions and conditions noted above. If voters approve the proposed amendment on November 6, Virginia localities would be prudent to watch this process carefully, as the details will impact the physical, philosophical, and political realities localities must navigate.

Virginia’s geographic diversity adds the first potential complication. While sea level rise and the associated tidal flooding components from coastal storms certainly warrant attention in tidewater Virginia, not all of the state’s recurrently inundated properties are flooded by tidal sources. Interior stream and riverine flooding across Virginia have wreaked havoc in 2018, causing multiple flooding events in the Roanoke and Dan River basins, for example. With the proposed amendment applicable statewide, the flood mitigation alternatives available for tidal and riverine settings often differ, and the “restrictions and conditions prescribed” will need to account for those differences through establishment of applicable mitigation metrics.

One potential model for tidal metrics comes from the Hampton Roads Planning District Commission (HRPDC), which recently adopted a resolution encouraging its member localities to plan for sea level rise. The region identified, and agreed to, local land use planning policy scenarios that included 1.5 feet of sea level rise for near-term decisions (2018-2050), 3 feet for medium term decisions (2050-2080) and 4.5 feet for long-term decisions (2080-2100)[1]. Could a similar scale of increasing flood resiliency over time be used to further define “flooding abatement, mitigation, and resiliency” measures for property subject to recurrent tidal flooding? How should the Federal Emergency Management Agency’s (FEMA) Flood Insurance Rate Map (FIRM) and associated Flood Insurance Studies (FIS) factor into tidal flooding mitigation standards?

For riverine flooding, the ballot measure’s needed definition also proves challenging. While FEMA FIRMs do provide floodplain definition and location, not all provide a Base Flood Elevation (BFE), or the computed water surface elevation of the so-called “100-year flood” (the flood that has a 1% chance of occurring in any given year). Other recurrently flooded properties may not even be in a FEMA-mapped floodplain. As such, even riverine flood mitigation requirements of BFE plus 1 foot or more may not provide the mitigation value anticipated over time, or be applicable to all flooded properties. The calculated 1% flood elevation is just that, a calculation based on historical rainfall data and established hydrologic curve numbers at the time of the study. As our hydrologic history — the period for which we have accurate rainfall records — lengthens, those numbers will change over time. Indeed, as The Pew Charitable Trusts’ flood-prepared communities initiative recently noted, 2018’s Hurricane Florence was the 12th 1,000-year rainfall event (or event that has a 0.1% chance of occurring in any given year, emphasis mine) in the U.S. since the beginning of 2016[2]. More frequent, significant rain events mean that flood elevations and metrics for effective mitigation remain a moving target, a concept reflected in the scaled planning targets in the HRPDC initiative.

Finally, in addition to these moving targets for establishing the effectiveness of specific mitigation measures, localities will also need to account for the vast range of property values subject to recurring flooding. With some exceptions, tidal and waterfront property is more valuable than non-waterfront property precisely because of its proximity to the ocean, bays, and waterways it borders. However, waterfront properties are not the only properties that flood repeatedly. Would a local policy to provide for a partial tax exemption for flood mitigation measures on inland properties be seen as more equitable than providing the same for more valuable waterfront property? As a local initiative, that partial tax exemption would come from the community’s local tax base as opposed to other sources from which traditional mitigation dollars flow. Based on the diversity of properties recurrently flooded, the answer will likely be “it depends,” impacting a locality’s ability to apply programming consistently.

We should applaud Virginia’s effort to identify and implement additional flood resiliency and mitigation tools to reduce the physical, financial, and emotional damage that recurrent flooding inflicts on the Commonwealth, and which may only get worse moving forward. While this brief examination of the ballot question cannot cover all of the potential policy, implementation, and philosophical questions that passage would introduce (e.g., further defining eligible mitigation practices, need to address existing FEMA regulation that differentiates allowable mitigation measures between residential and non-residential properties, local implementation consistency and oversight, etc.), it may highlight some of the complexities embedded in what looks like a simple question, and — if the measure passes — help those charged with defining its parameters avoid the creation of one of the more common laws we all experience from time to time: the law of unintended consequences.

About the author:

Doug Moseley is the Director of Water Resources Policy & Planning for GKY & Associates, Inc. He can be reached at dmoseley@gky.com.

[1] McFarlane, Benjamin, “Region Adopts Sea Level Rise Planning Policy”, Hampton Roads Planning District Commission Planning News, October 24, 2018.

[2] Fuchs, Matthew, “House Joins Senate in Effort to Improve U.S. Flood Readiness”, The Pew Charitable Trust, October 18, 2018.